By Lawrence Agcaoili | The Philippine Star | January 24, 2014

MANILA, Philippines - Infrastructure giant Metro Pacific Investments Corp. (MPIC) is urging the Aquino administration to reconsider its proposal to expand the congested Metro Rail Transit line 3 (MRT3) along EDSA in light of the proposed P56-billion transaction for the complete government takeover of the country’s major mass transit system.

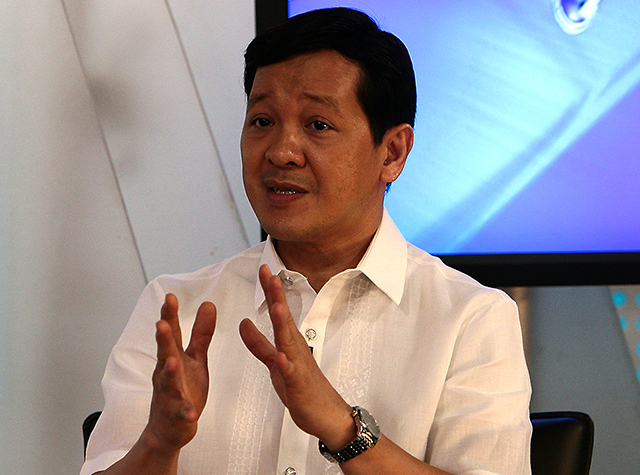

MPIC president and chief executive officer Jose Maria K. Lim said in an interview with reporters that the Department of Transportation and Communications (DOTC) should consider the company’s proposal to spend $300 million for the expansion of the MRT 3.

“The buyout that has been contemplated by government is in that equity value buyout. What we proposed to government is for them to allow or to consider the expansion plan proposed by MPIC and that does not invoke the equity value buyout because it works in the existing BLT agreement,” he said.

Through an unsolicited proposal, the unit of First Pacific Co. Ltd. of Hong Kong offered to spend $300 million to expand MRT3’s capacity and another $350 million to acquire equity and bonds issued by Metro Rail Transit Corp. (MRTC).

MPIC has a 48 percent interest in MRTC after it entered into cooperation agreement with the Sobrepeña-owned Fil-Estate Corp. in November 2010 regarding its interests and rights in Metro Rail Holdings Inc., Metro Rail Transit 2 Inc., and Monumento Rail Transit Corp.

On the other hand, government financial institutions Land Bank of the Philippines and Development Bank of the Philippines (DBP) own an 80 percent interest but have no voting rights in the company.

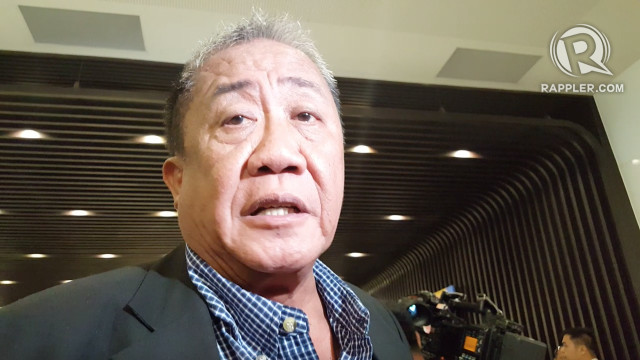

Transportation Secretary Joseph Emilio Abaya said the P56 billion budget for the complete government takeover of MRT3 is available as it was included by the Department of Budget and Management (DBM) in the P2.265 trillion 2014 national budget.

In March last year, President Aquino signed Executive Order 126 stating that DOF and DOTC should buy out MRT 3 from MRTC pursuant to a build-lease-transfer (BLT) agreement.

The proposed takeover would help Landbank and DBP unload their interest in MRT3 after receiving several warnings from the Bangko Sentral ng Pilipinas (BSP) regarding its investments in the mass transport system.

The plan to buy out the private sector’s stake in the MRT3 would also mean the government would no longer need to pay MRTC huge fees every year. The DOTC annually pays the MRTC for equity rental payments, maintenance cost, debt guaranteed payment, insurance expenses, and others.

Twitter

Twitter Facebook

Facebook