By Alex Magno (FIRST PERSON) | The Philippine Star | September 4, 2014

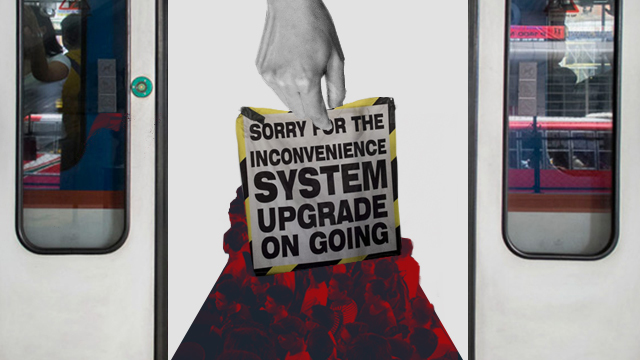

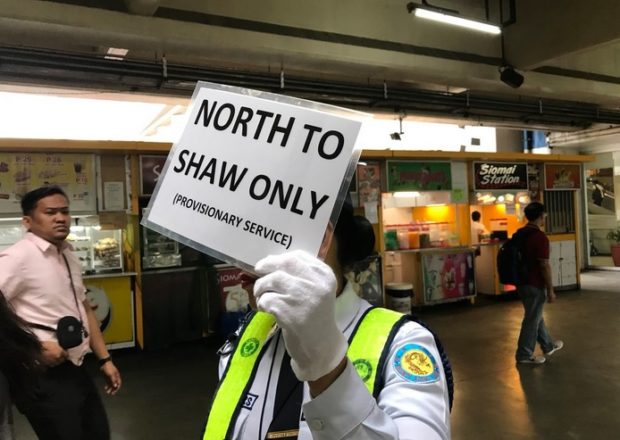

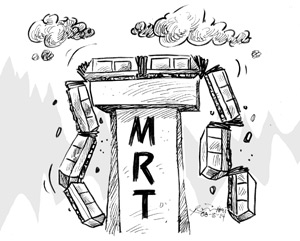

While DOTC officials were unloading bovine manure at the Senate hearing last week, an MRT carriage was photographed running with its doors open. It is really only a matter of time before this killer train line takes horrendous casualties.

While the DOTC promised largely cosmetic improvements to the rail line (platform edge doors, a noise barrier, umbrellas for those waiting in the long queues and, yes, free wi-fi), the officials did not honestly confront the horrible maintenance record of this public conveyance.

Nor did they explain why notice of public bidding was made only five days before the contract of the current maintenance provider expires. The DOTC pulled this trick before. They contracted APT Global to provide maintenance without proper bidding because there was no material time to do so. Since APT Global took over, the service broke down with regularity.

DOTC raises grand hopes new trains will start arriving a year from now. That hope might be unfounded. The Chinese supplier contracted to supply those new trains makes locomotives and has never fabricated the double-articulated carriages MRT-3 uses.

DOTC is asking government for more money to do train overhauling and replacement of traction motors. They conveniently forget to mention that in the old contract with maintenance provider Sumitomo, both items were part of the standard maintenance contract and did not require a separate budget. In the old contract, it was the responsibility of Sumitomo to overhaul the trains every five years (replacement of the traction motors is the main item in the overhaul).

DOTC tries to pass the blame by saying that MRTC (the private owner of the line) failed to invest in system upgrade. They forget to mention that five times in recent years, MRTC did offer to upgrade. Five times, for unknown reasons, the DOTC rejected the offer.

Of all the nonsense the DOTC has been dishing out, this one takes the cake.

The DOTC says it is asking for a budget of P56 billion to acquire the MRTC. After nationalizing the MRTC, they will then proceed to privatize it. This is complete nonsense.

To begin with, the money quoted by DOTC is only enough to purchase the economic interests of the DBP and the LBP in the MRT. It will, therefore, result only in transferring money from one government pocket to another.

An equity value buyout is not something government can undertake on its own. It is a right that belongs to MRTC. When Elliot Associates and Goldman Sachs filed an international arbitration case against the Philippine government in 2009 for failing to pay MRT rentals, the quoted price for an equity value buyout was $2.5 billion (or a little over P100 billion).

In a word, not only will the proposed buy-out fail to transfer ownership to government, it will not solve the maintenance issues plaguing the rail service.

The MRTC, by the way, is 100% owned by MRT Holdings — held in nearly equal parts by six business groups, including the Ramcar group, Ayala Land, Unilab, Fil-Estate and the National Bookstore group. Bob Sobrepena, DOTC’s chosen villain, is not even on the MRTC board.

Collateral damage

While Pag-IBIG Fund and Delfin Lee’s Globe Asiatique (GA) are fighting complex legal battles in several judicial venues, what happens to the hundreds of families who invested in the homes that are now the subjects of controversy?

Scores of adversely affected homeowners have joined Delfin Lee as “unwilling co-plaintiffs” in a suit filed against the Home Development Mutual Fund (HMDF) and the Register of Deeds of Angeles, Pampanga. The complaint was filed at the Angeles City Regional Trial Court.

The homeowners invested good money in homes built by GA in Pampanga. The HDMF accuses GA of fraud, basically reporting “ghost” buyers. The plaintiffs are basically saying they are real buyers and deserve to have the properties they bought titled in their name.

Since the HDMF does not recognize the transactions, the homeowners now find themselves in some legal limbo. They live in homes that could not be fully documented. They are asking the court to compel HDMF to properly recognize the transactions they made with GA.

This adds yet another wrinkle to an already complicated legal issue.

The Makati Regional Trial Court Branch 58 in Civil Case 10-1120 ruled that Pag-IBIG Fund (HDMF) is liable to Globe Asiatique for breach of contracts. The Court of Appeals (CA) affirmed that ruling. The CA likewise voided and quashed the information for syndicated estafa against Delfin Lee for lack of probable cause.

HDMF, however, petitioned the Supreme Court for a temporary restraining order against the CA decision. The petition was granted. On that basis, Lee was arrested and jailed without bail for syndicated estafa — even if the ruling of the CA quashing the complaint against Lee was not overruled.

Lee, for his part, petitioned the High Court, arguing that a mere TRO cannot suspend his constitutional rights to liberty since the warrant of arrest issued by the Pampanga trial court was already recalled, lifted and quashed by the CA. He is asking the High Court to clarify the legal basis for his detention without bail a well as his arraignment at the Pampanga trial court for a criminal case already voided by the CA.

Oral arguments on these issues are reported to be finally scheduled for next week. It does not seem, however, that the judicial process on this matter will be concluded anytime soon.

In the meantime, as things go through the long grind, what happens to the hundreds of homeowners who bought property from GA and who are entitled to legal recognition of their claims?

Twitter

Twitter Facebook

Facebook