By Cliff Harvey C. Venzon

ONE of the private investors in Metro Rail Transit Line 3 (MRT-3) is open to selling its interest to the government “if the price is right,” a senior company official said last week.

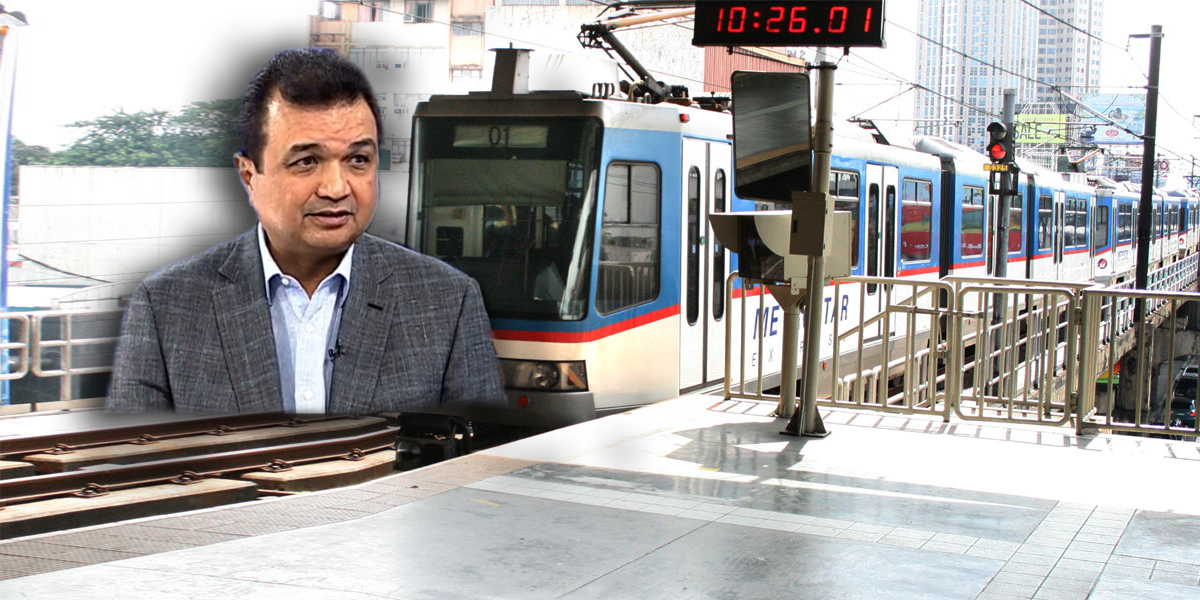

“If the price is right, we sell. If there is a reasonable compensation, we sell,” Adrian S. Arias, executive vice-president of Anglo Philippine Holdings Corp., told reporters on the sidelines of the company’s stockholders’ meeting in Mandaluyong City last Wednesday. According to Mr. Arias, Anglo Philippine has 18.6% “residual interest” in Metro Rail Transit Holdings, Inc., owner of Metro Rail Transit Holdings II, Inc., which in turn controls Metro Rail Transit Corp. (MRTC) -- the concessionaire of MRT 3. Mr. Arias could not give the value of the company’s interest in MRT-3. However, Finance Secretary Cesar V. Purisima last week estimated that total private sector interest in the line was worth $200 million, or a fifth of $1-billion total value of the entire concession.

The other private investors of MRT-3 include Fil-Estate Corp.; Railco Investments, Inc.; Sheridan LRT Holdings, Inc.; and DBH, Inc., according to data from the Transportation department. The state holds a 77% economic interest in the firm through Land Bank of the Philippines (Landbank) and Development Bank of the Philippines (DBP) by virtue of its purchase of asset-backed bonds issued by MRTC’s original owners, but it does not have voting rights.

MRTC is controlled by Metro Pacific Investments Corp. by virtue of a “cooperation agreement” in 2010 with Fil-Estate Group, which had the biggest stake MRTC.The buyout is being planned pursuant to Executive Order (EO) 126 issued last Feb. 28. EO 126 directed the Finance and Transportation departments, Landbank and DBP to execute the buyout either through equity purchase involving all outstanding shares of stock and other securities issued by MRTC and/or entities owning MRT-3, or an asset purchase of all rights, titles and interests held by MRTC.

Twitter

Twitter Facebook

Facebook