By Lorenz S. Marasigan | Business Mirror | October 27, 2015

Conclusion

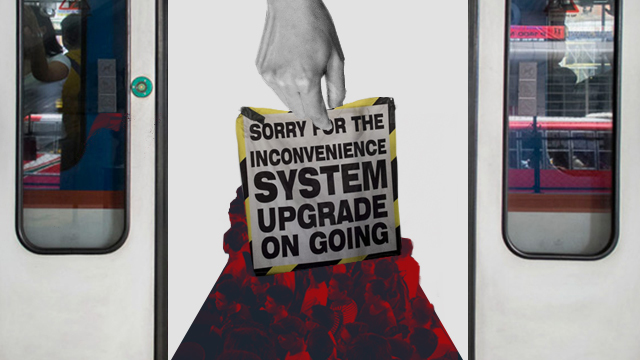

THERE is no stopping the government from executing the multibillion-peso buyout of the Metro Rail Transit (MRT) Line 3’s private owner, even if experts see it as an unfitting way to address the chronic problems of the train system.

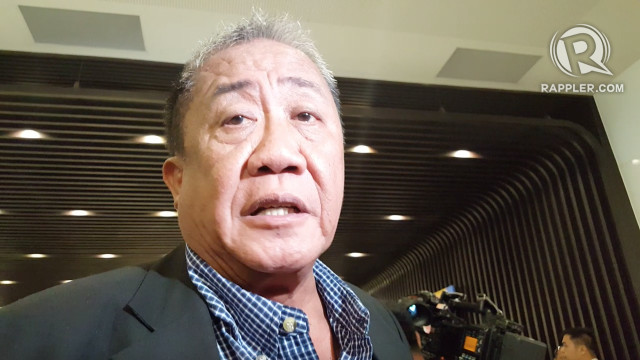

Once the planned takeover has been completed, money being pumped into the development of the train system will then be sound investments, Transportation Secretary Joseph Emilio A. Abaya noted. Today the government spends public funds to finance the improvement of a train line owned by a private company.

“One of the problems that the buyout will solve, at least on the budget side, is that we will then be investing in a government-owned facility, because we are now investing in a privately owned facility,” he explained.

In order to spend money for the modernization of the train line, the Department of Transportation and Communications (DOTC) has to place special items on its budget under the “leased facilities” component.

“There is a special item on the budget on how we improve leased facilities,” he said. “We could make better decisions when we become the owner. It frees us from talking to other parties, with the fear of opinions coming from the left field.”

Proposals left to gather dust

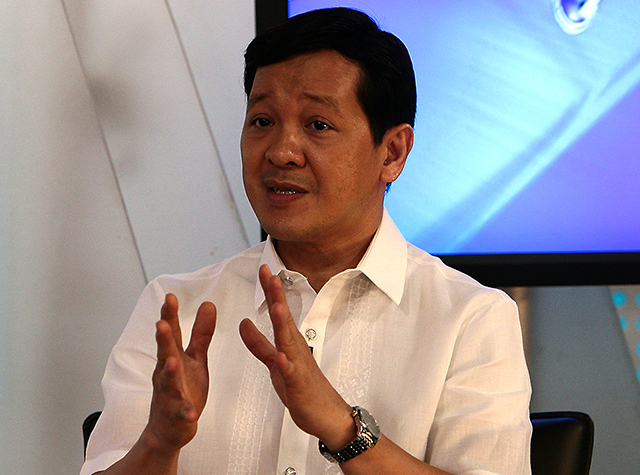

Metro Rail Transit Corp. (MRTC) Director Rafael R. Perez de Tagle Jr., however, believes that a buyout is not necessary to improve the train line, after all, the build-lease-transfer agreement between the government and private sector requires the two parties to cooperate with each other to improve the train line.

All that is needed, he said, is for the government to be open to proposals sent by the private partner —even those that merely want to help in modernizing the train line that serves more than half-a-million Filipinos daily.

The executive, who also sits as the president and COO at Fil-Estate Urban Development Corp., a shareholder in MRTC, noted that an equity-value buyout could only mean that there happens to be—what he called—an “economic sabotage.”

“The equity-value buyout, which Executive Order [EO] 126 espouses, is not possible because a buyout

requires declaring the government in default. As per the build-lease-transfer agreement, this is a remedy available only to the owner, the MRTC, and not to the DOTC,” he said.

Perez de Tagle alleged that people whispered wrong information to President Aquino, leading him to sign the EO in 2013. This, he said, would cause an economic shakedown, and pull the country down from its current rise as one of the fastest-growing economies in Asia.

“So why would the government declare themselves in default and cause our country’s credit rating to deteriorate? It is obvious that people have fed misinformation to the President, which led him to sign an erroneous order—that would look like economic sabotage,” he said.

Proposals to develop the line, the official said, were already in place— even before President Aquino took office in 2010.

“Even if the [Gloria Macapagal] Arroyo administration ignored the previous private-sector proposals to expand and upgrade the capacity of the MRT, this current administration would have had doubled the capacity of the MRT by last year, if only they followed the build-lease-transfer agreement and agreed to work with the private owners to expand the MRT 3’s capacity at no cost to the government,” he said.

Metro Global Holdings Corp., a stakeholder in MRTC, had proposed to shoulder the multibillion-peso upgrade of the train line.

Together with foreign firms Sumitomo Corp. of Japan and Globalvia Infrastructuras of Spain, Metro Global Holdings offered to “fix” the sailing system through a $150-million investment that involves the procurement of a total of 96 new train cars, as well as the rehabilitation of the existing 73 coaches, increasing its capacity by fourfold to 1.2 million daily passengers.

Under the proposal, a single point of responsibility will be implemented, meaning the rehabilitation and the maintenance of the line will be handled by a single company.

“Our proposals to rehab, upgrade and fix the MRT 3 system, at no cost to the government, have come by way of first, the proposal of the fast-track rehab of Metro Global Holdings to repair and rehab 19 kilometers of new rail and overhaul all 73 light-rail vehicles in the system. This, with an upgrade of the existing signaling system for $97 million at no cost to the government,” MRT Holdings II Inc. (MRTH) Chairman Robert John L. Sobrepeña said.

The second phase of this proposal is to add new trains and implement the capacity-expansion program for the MRT 3 project—all of which will come at no cost to the state.

“The private sector will be repaid from fare box revenues from the MRT collections, wherein the price of the fare box will not be higher than the prevailing bus fare pricing,” Sobpreña said. Currently, fare prices of the MRT is cheaper when compared to the ticket prices of buses that ply the same route.

“This is the best solution and all without DOTC spending a single centavo on the rehab and upgrade, not to mention saving P7 billion per annum in tax payers’ money in subsidizing the MRT 3 project, since private sector will take over maintenance and operation of the system and fund any shortfall,” Sobrepeña noted.

“They have not acted in all our proposals, so how can we move if they don’t want us to move and fix the problem?” he added.

Separately, Metro Pacific Investments Corp. (MPIC) is proposing to shoulder the upgrade costs of the train system and release the government from the bondage of paying billions of pesos in equity rental payments.

The group of businessman Manuel V. Pangilinan, which earlier entered into a partnership agreement with the corporate owner of the MRT, intends to spend $524 million to overhaul the line.

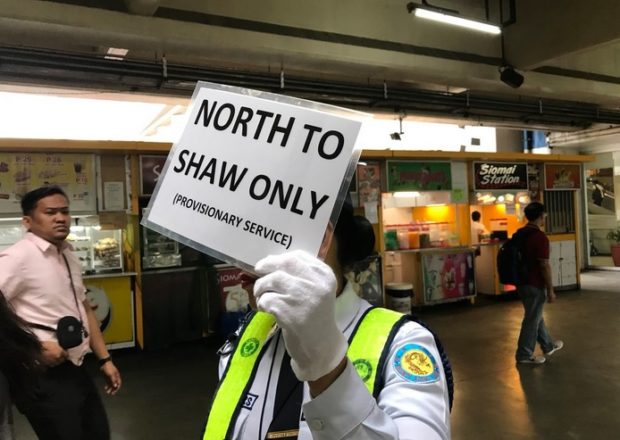

The venture would effectively expand the capacity of the railway system by adding more coaches to each train, allowing it to carry more cars at faster intervals. The multimillion-dollar expansion plan would double the capacity of the line to 700,000 passengers a day from the current 350,000 passengers daily.

It was submitted in 2011, but the transportation agency’s chief back then rejected the proposal.

On the other hand, German firms Schunk Bahn-und Industrietechnik GmbH and HEAG Mobilo GmbH are seeking to place the whole train system under a massive transformation program to augment its capacity and to provide a safe and comfortable travel to commuters from the northern and southern corridors of Metro Manila.

The P4.64-billion proposal, submitted in February with Filipino partner Comm Builders and Technology Phils. Corp., calls for the complete overhaul of the 73 light-rail vehicles of the MRT, replacement of the rails, upgrade of the line’s ancillary system, upgrade of the track circuit and signaling systems, modernization of the conveyance system and a three-year maintenance contract.

These are left to gather dust in the office of Abaya. Currently, the government is implementing a P9.7-billion multiyear venture to overhaul the line. The complete makeover is expected to be done within the term of President Aquino.

“The current state of disarray of the MRT 3 is solely the fault of DOTC! They removed Sumitomo Corp. and awarded the maintenance to unqualified local service providers who never provided for parts for the maintenance of the system,” Sobrepeña said.

PPP might be the solution

But, for Abaya, the only way to effectively improve the train line is to eliminate opposition, which mainly comes from temporary restraining orders (TROs) being lodged against his office in developing the train line.

“When we have successfully executed the buyout, there will be no more TROs from the private sector,” he said.

The transportation department was peppered with stay orders in past years, with one particularly significant and very controversial.

Two years ago, a Regional Trial Court ordered the transportation department to temporarily stop the purchase of new MRT trains from Dalian Locomotive and Rolling Stock Co., as the private partner wanted to have a hand in the procurement of new trains.

The case is still pending before the Supreme Court, but the Chinese manufacturer has vowed to deliver the 48 new trains through 2017 starting in the first quarter of 2016.

“Right now, people get the impression that we are blaming each other, but when we get to take over the line, we will now have a government-owned, government-operated, government-maintained facility,” he said in a mix of Filipino and English.

The next step after the buyout is for the government to bid out the operations and maintenance (O&M) contract of the railway facility to the private sector.

This, however, will take time.

“The next level is to bid out the O&M, but that, I’m sure, won’t be done during this administration because we have to have a feasibility study first before going to the Neda [National Economic and Development Authority] Board,” the transport chief said, referring to the Neda Board.

The auction for the contract will be done under the Public-Private Partnership (PPP) Program, the flagship infrastructure-development measure of the Aquino administration. “What will happen there is that the next secretary will decide if he wants to follow what happened with the Light Rail Transit Line 1 —wherein private sector operates and the government owns,” Abaya said. “He could decide whether to continue that or to totally ignore our proposal to bid out the O&M of the MRT under the PPP Program.”

He added: “It is really best left to private sector, then the government is the regulator.”

Business leaders find good purpose to this initiative, saying that they are ready to aid the government in its bid to procure a private-sector partner for the operations and maintenance of the train system.

“It’s difficult to speculate on whether the MRT will drastically improve after a buyout, since substantial improvements still have to be done. Nevertheless, the private sector does have the technology and expertise to properly operate a transport system. Should a buyout occur, the government must ensure that a competent private partner be engaged in improving and running the system,” Makati Business Club Executive Director Peter

Angelo B. Perfecto said.

American Chamber of Commerce Senior Advisor John D. Forbes echoed Perfecto’s sentiments. he, however, noted some constraints in foreign business’s partnership with the government.

“We are advocating a credible and transparent bidding and awards process for PPP and public-sector projects. Also, we advocate the repeal of the 1936 Flag Act and other restrictions on foreign participation in the infrastructure sector, including the 60-40 restriction on ownership and operation of public utilities in the constitution. When the playing becomes level, we will ask more foreign companies to invest here,” he said.

However, European Chamber of Commerce of the Philippines External Vice President Henry J. Schumacher, seem to have lost all hope in the Philippine government, known to many as filled with so much bureaucracy and corruption.

“With the present snail pace on biddings, no, it would not be too much of a solution. It needs crisis decisions with the Commission on Audit being party to the deal,” he said.

Jose Regin F. Regidor, a transportation expert, added that the government will have to be more prudent in finding good and honest partners—not to mention that these parties should also have a good track record in providing good service—if it really wants to pursue traversing this road.

“What we know now, based on past experiences, is that the government is not that good in operating or managing systems,” he said. “But then, the question then as now is if the government can attract good managers, leaders to be able to manage these systems efficiently and, very important, profitably. That means a good compensation and perhaps little intervention by national government in operations.”

‘Folly’

The current mess with the MRT is a classic example of how the government should be prudent and careful in entering into partnerships with the private sector. Buying out the line might be a solution, but this jumble should teach the government lessons in handling public utilities.

“The main or root issue seems to be legal and not at all technical. The technical problems experienced are manifestations of a contract that is a textbook case for how not to do a PPP,” Regidor, a research fellow at the University of the Philippines-Diliman National Center for Transportation Studies, said.

“We now know it is not favorable to the public and that the current and future officials should learn from this lesson from a past PPP project. Hopefully, current and future PPPs will not be like the MRTC deal,” he added.

Regidor, however, dissuaded the government from its seemingly late decision to buy the private partner out in the MRT, as the public opinion might be geared toward the negative.

“I would think that the general public would see this as another folly for the government given the way it has fumbled with this matter,” he said.

Twitter

Twitter Facebook

Facebook