By Mary Ann Ll. Reyes | The Philippine Star | May 7, 2014

I do not know Delfin Lee nor have I dealt with him or his real estate company Globe Asiatique either personally or professionally.

But what I do know is that based on what I have read or heard on the news, I am only being presented one side of the story.

And so the search for the other side of the story.

Lee, who is now behind bars, wants an audience with the Senate. His lawyers want his case set for oral argument by the Supreme Court. His camp wants to be able to present their side of the story, which unfortunately has not been presented completely in media due to the complexity of the legal and political issues involved.

Their argument can be summarized as follows: First, that the government did not sustain P6.6 billion in damages as claimed (from money extended to GA). Second, there are no ghost or fictitious buyers to its Xevera projects in Pampanga. Third, there were no double sales. Fourth, there was no syndicated estafa (the reason for the warrant of arrest against Lee). Fifth, it was Pag-Ibig which reneged on its part of the deal.

Based on news reports, there are also other issues that have surfaced – one of which claims that Lee was the victim of the ongoing Binay-Roxas maneuverings for the 2016 presidential elections. The other, that Lee has had dealings with the Home Guarantee Corp. (HGC), in particular that the latter’s bond flotation which was a source of funding for Lee which the latter categorically denied by saying that he has had no dealings with HGC either directly or indirectly.

Business

But coffee shop habitués would ask these obvious questions – one, if the alleged buyers are fictitious or ghost, why did Pag-Ibig approve the loans in the first place? Two, why does Pag-Ibig now refuse to accept loan payments from the other “legitimate” buyers? Third, if only less than 100 out of 10,000 unit owners (38 to be exact) at Xevera are allegedly complaining, then isn’t is just possible that they are just making noise to mislead the public from the real issue?

(To be continued)

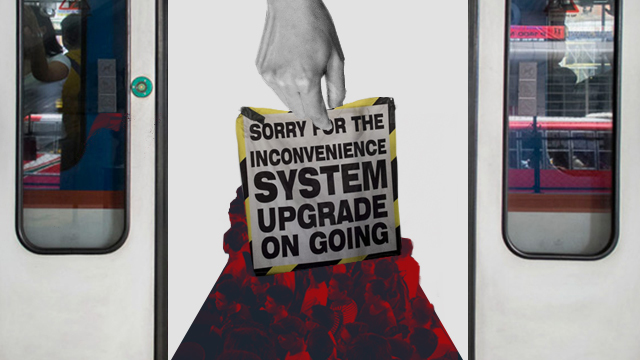

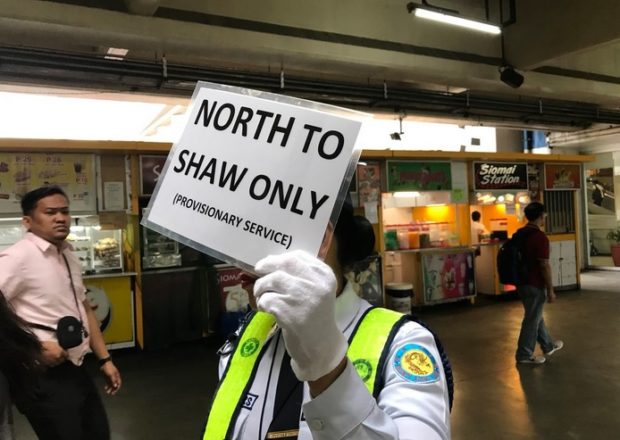

Excuses, excuses

Metro Rail Transit (MRT) general manager Al Vitangcol recently blamed former President Gloria Macapagal-Arroyo and the MRT Corp. (MRTC) for the inefficiencies of MRT Line 3.

But records would show that MRTC had made four proposals during the past administration to acquire additional LRVS at no cost to taxpayers.

The DOTC ignored all those proposals and insisted instead on the purchase of refurbished or second-hand trains.

MRTC made a fifth offer when Interior Secretary Mar Roxas was still DOTC secretary. Instead of accepting the proposal, the DOTC opted to award a contract to lone bidder Dalian Locomotive & Rolling Stock Co. (Dalian) to supply 48 new trains, without seeking prior MRTC consent, in gross violation of their build-lease-transfer agreement.

MRT 3’s problems took a turn for the worse in 2012 when DOTC replaced longtime maintenance provider TES-P of Sumitomo Corp. of Japan (TES-P/Sumitomo), which had handled MRT 3’s operations and maintenance for 10 years straight.

After the expiry of TES-P/Sumitomo’s contract, the PH Trams-Comm Builder Technology Philippines Corp. (CB&T) took over the maintenance of MRT3 for almost a year, after which it was taken over by its current operator Autre Porte Technique Global Inc. (APT Global).

Curiously enough, DOTC has refused since 2012 to allow MRTC to enter the MRT Depot, which is still owned by this private firm until the end of the BLT agreement in 2025.

This has prompted MRTC to repeatedly request DOTC for an independent third-party technical audit of the MRT 3 system, but the department has ignored all of these requests.

Speculations are rife that DOTC refuses to allow MRTC executives and their hired experts to enter the MRT Depot in order to cover up the true state of deterioration and reported cannibalization of parts from other trains ever since this department took over the system’s train maintenance work.

MRTC directors Rafael Perez de Tagle Jr. and Rogelio Bondoc Jr. In a letter to President Aquino, said that the reported accidents and shortages of trains only occurred after the DOTC took over the maintenance of the MRT 3 System last October 2012.

Meanwhile, in a separate letter to President Aquino, the same MRTC directors pointed out that DOTC’s recent award of a contract to the Chinese firm Dalian Locomotive for the supply of 48 LRVs was in violation of the Revised Build and Lease Agreement – dated Aug. 8, 1997 – between the Philippine government, through DOTC, and MRTC.

Vote of confidence

General Santos City-based seafood processing giant Alliance Select Foods International got a resounding vote of confidence last Monday when a new strategic investor bought 430 million new shares.

The big chunk of shares bought in a private placement by Strong Oak, Inc. represents 28.7 percent of Alliance’s total issued capital of 1.5 billion shares.

The new investor’s acquisition price of P1.31 per share was a 3.3 percent premium over the 30-day volume weighted average from March 18 to May 2, 2014.

Strong Oak has seen the numbers and liked what it saw, contrary to what the Singaporean minority in Alliance are saying (two foreign minority stockholders, who are actually members of the Alliance board, went to court to force the firm to open its financial records, citing alleged violations of the Philippine Corporate Code).

Alliance over the years has maintained its strong position as a supplier of seafood to hundreds of brand-name companies across 60 countries.

It produces over 200 metric tons of seafood daily and the entry of Strong Oak would allow it to extend its reach outside of Southeast Asia where it is already a seafood processing powerhouse. It has also acquired a New Zealand-based company, Akaroa Salmon NZ, Ltd., to tap into the global smoked salmon market.

Company officials say that the infusion of funds from Strong Oak will enable the company to generate greater income from its assets and significantly increase its plant utilization rates at its canned tuna facilities in General Santos City.

Twitter

Twitter Facebook

Facebook