By Doris C. Dumlao | Philippine Daily Inquirer | August 7, 2011

HONG KONG—Infrastructure holding firm Metro Pacific Investments Corp. has initiated talks with the new leadership at the Department of Transportation and Communications (DoTC) to revive its bid to rehabilitate and upgrade the Metro Railway Transit Line 3, the Philippines’ biggest elevated railway system line.

The group has drawn up an “improved” proposal on a 30-year MRT 3 concession, which is estimated to require $650 million in investment, of which $300 million will be in equity contribution for the expansion of railway capacity and $350 million for the acquisition of equity and some of the bonds issued by operator Metro Rail Transit Corp., top company officials said.

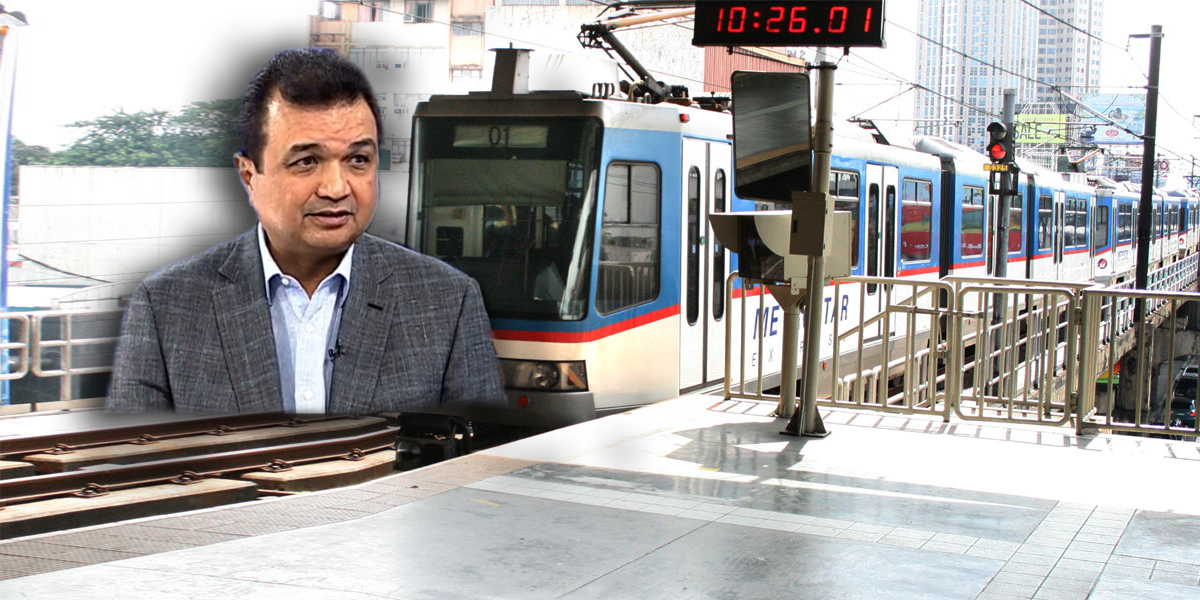

MPIC president and chief executive officer Jose Ma. Lim said in a briefing on Friday at the head office of MPIC’s parent First Pacific Co. Ltd. that the group’s earlier proposal was shelved as the DoTC had intended to bid out a concession contract to operate the MRT3.

“I think the new leadership in DoTC [under Secretary Mar Roxas] is reexamining that plan and announced they won’t proceed with the bidding while studying what to do next,” Lim said. “We’re starting to discuss our proposal with the new team and we are hopeful that the proposal will be better received.”

Under the proposal, a Metro Pacific-led consortium will double the capacity of MRT 3 at a total cost to the consumer that will not exceed current bus fares. It is also willing to subject its proposal to a “Swiss” challenge, which means other bidders will have the chance to top its offer but as original proponent, MPIC will have the right to match the best offer.

“We have improved it in the sense that initially, we didn’t offer to do the Swiss challenge but when they said transparency will be an issue, we said okay, let’s subject it to that,” Lim said.

“But from the very start we already told them we’re removing the onerous provisions in the old contract like the guaranteed yield of 15 percent [to the MRT 3 operator]. We’ll take market risk. We offered to cover 40 percent of the subsidies that the government is now paying and this relates to the bonds that are held by current third parties,” Lim added.

Part of the proposal is to buy out state-owned banks Development Bank of the Philippines and Land Bank of the Philippines, which own a combined 22 percent of equity in the MRT 3 project but 75 percent of economic rights through bondholders.

MPIC has already signed a “cooperation” agreement with various groups relating to rights and interests in MRT 3 companies—namely Metro Rail Transit Holdings Inc., Metro Rail Transit II Inc., Metro Rail Transit Corp. (MRTC) and Monumento Rail Transit Corp. This includes the interest held by the group of businessman Robert John Soprepeña.

A “cooperation” agreement gives MPIC the option to take over their shares if the concession proposal is accepted by the government. In addition, MPIC has signed agreements with other shareholders to either buy their shares or take over their voting rights, which could give it an equity control of 48 percent and voting rights of more than 70 percent, Lim said.

The earlier reported $1.1-billion MRT 3 takeover proposal pertained to the valuation of certain assets owned by the MRT3 consortium, not all of which MPIC is offering to buy, MPIC chief finance officer David Nichols said.

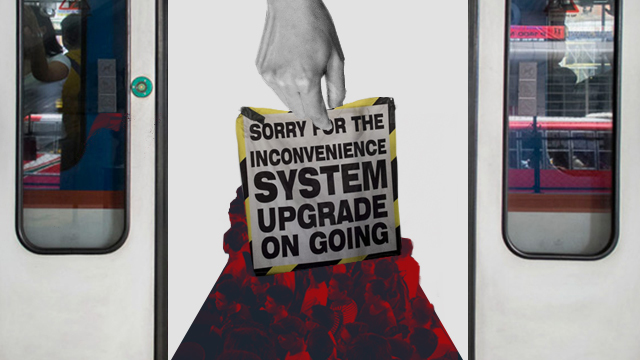

MPIC’s expansion plan seeks to double the capacity of MRT 3 line running the stretch of Edsa to 700,000 passengers a day from the current 350,000, Lim said. This is to be achieved with the purchase of new cars, upgrading of signaling equipment, improving the frequency of train departures and lengthening the number of cars per train.

“Instead of three cars to one train, it could be four cars so that trains will be carrying more cars at faster intervals. It will require upgrading of signaling and communications as well,” Lim said.

If and when MPIC’s proposal is accepted, he said the group could mobilize resources within six months and execute actual expansion within 12 to 18 months.

Twitter

Twitter Facebook

Facebook