MANILA, Philippines – The government’s over P50-billion bid to buy the Metro Rail Transit Line 3 (MRT3) from private shareholders falls short of the total equity value of the railway system, the owner of MRT3 under a build-lease-transfer (BLT) contract said.

David Narvasa, spokesperson of Metro Rail Transit Holdings (MRTH), said the amount the government earmarked to commence a takeover of the MRT3 system only covers the bonds bought by state-run Development Bank of the Philippines (DBP) and Land Bank of the Philippines (LBP).

“[It] is not enough,” Narvasa told reporters on Tuesday, September 2.

In 2013, President Benigno Aquino III, through Executive Order (EO) 126, ordered the takeover of Metro Rail Transit Corporation (MRTC), which holds the BLT contract for the 17-kilometer MRT3. MRTH owns MRTC.

Following the EO, the government allotted P56 billion for the equity value buyout. The amount was included in the P2.265-trillion national budget for 2015.

The EO directed the Department of Transportation and Communications (DOTC) and the Department of Finance to buy all shares of stock and securities issued by MRTC and other entities owning the railway, their rights and titles, pursuant to the BLT contract.

Currently, LBP and DBP hold a combined 80% economic interest in the MRTC, but without voting rights.

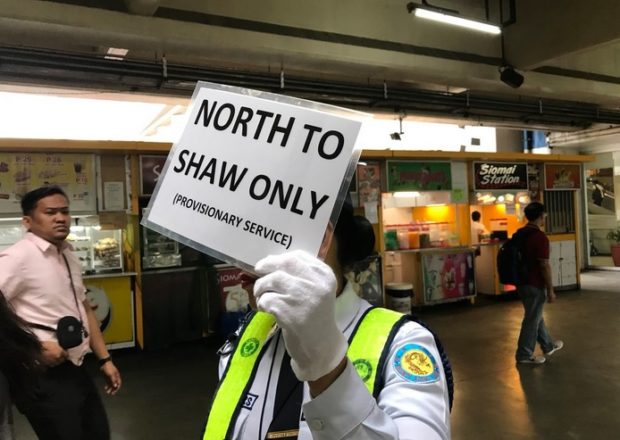

‘Buyout won’t help commuter sufferings too’

Narvasa said the government takeover would not solve the problems of the commuters taking the ailing mass transit system.

“An equity value buy out will not address the problem of safety. The problem of safety can only be addressed by getting a qualified maintenance provider,” Narvasa said.

“An equity value buyout is a right given to MRTC in case of default of the government. The government has to first be in default. If DOTC says they insist on an equity value buyout, are they saying they are in default?” he added.

But DOTC spokesman Michael Arthur Sagcal said the BLT contract allows the parties to mutually agree on a buyout to end the partnership.

Sagcal also told Rappler to “double check” whether Narvasa was authorized to speak for MRTC.

“When MRTH II filed a case to stop DOTC from adding train cars last February, they used MRTC’s name too but MRTC later disowned it as an unauthorized suit,” he said in a text message.

Meanwhile, the government pays MRTC annually for rental, maintenance, debt and insurance costs, and a 15% guaranteed return on investment.

In January 2009, MRTC filed an arbitration case against the government for failing to pay rentals on time.

DOTC Secretary Joseph Emilio Abaya said it would be easier for government to operate and maintain MRT3 after the takeover as it would not need the consent of private entities in any decision. He added the buyout would help the government save billions of pesos in annual subisidies.

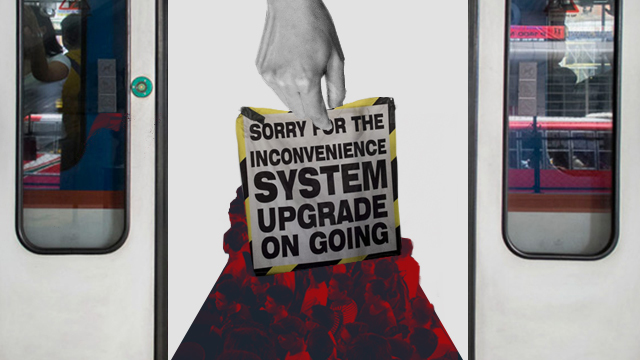

MRT3 is due for an upgrade with the acquisition of 48 new trains, said Abaya.

The upgrade was initiated by the government after the owner failed to upgrade the ridership capacity of the train system. – Rappler.com

Twitter

Twitter Facebook

Facebook