By Kris Bayos | September 2, 2014

The government needs more than P53.9 billion to buyout the private owner of the Metro Rail Transit (MRT) line 3 and to completely take over the aging mass transportation system.

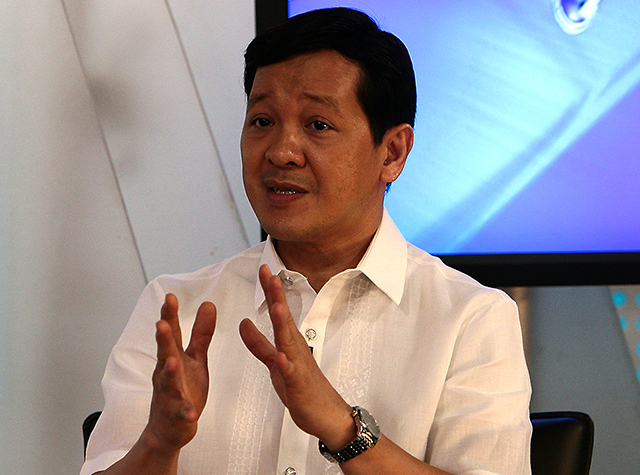

Atty. David Narvasa, spokesperson of the MRT Holdings (MRTH), said the budget allocated by the Department of Transportation and Communications (DOTC) and Department of Finance (DOF) is “not enough” to buyout MRT Corp., which is 100 percent owned by the MRTH.

According to Narvasa, the P53.9 billion allocation for the MRTC equity value buyout (EVBO) can only pay for the bonds held by state-owned Developmental Bank of the Philippines and the Land Bank of the Philippines, which represent only 80 percent of the MRTC-issued bonds.

“Definitely, it (P53.9 billion) is not enough to buyout the MRTC. It only represents the bonds held by the DBP and LBP, excluding the outstanding 20 percent of bonds and the remaining rights of the shareholders,” Narvasa told reporters yesterday.

Narvasa said MRTH is open to the government’s planned EVBO of MRTC but clarified that “nobody from the government has talked to any of the shareholders.” Citing the Corporation Code of the Philippines, he also stressed that government needs to get the consent of the two-thirds of the MRTC shareholders for the sale of the MRT-3 system.

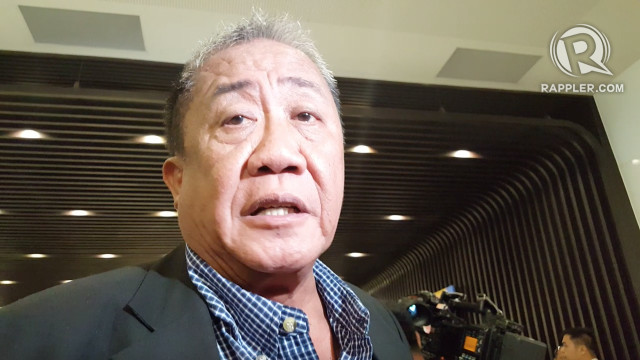

But Transportation Secretary Joseph Emilio Abaya claimed that it was the MRTC that wanted the government to execute an EVBO when it filed an arbitration case against the government in 2008.

“It was MRTC that went to arbitration for government to buy them out through an EVBO. We are merely following the logical course,” said Abaya, who would not immediately say the basis for the P53.9 billion valuation.

“We are open to the idea of a buyout but it would depend on the terms and conditions,” Narvasa said but would not disclose the exact amount needed for the EVBO.

Contrary to government claims, Narvasa said MRTC has been proposing to expand the capacity of the MRT 3 system by procuring additional trains back in 2002, 2008 and 2010 but the DoTC has not acted upon the separate requests.

“Under our BLT (build-lease-transfer) agreement with government, we cannot do it (capacity expansion) unilaterally. The government should approve it before we implement but there was no response from their end,” he pointed out.

Reacting on Senator Francis Escudero’s proposal to sue the MRTC due to the failed capacity expansion of MRT 3, Narvasa threw the blame back to DOTC for not responding to the MRTC’s proposals.

“We can only be sued if we are in breach of the contract. But records will show that we have been complying with the contract and the MRTC and MRTH continue to play by the rules,” he said.

Narvasa appealed for government’s cooperation in the MRTC’s plan to upgrade the 15-year-old MRT 3 system.

“We hope government would work hand-in-hand with MRTC in getting a technically competent and financially capable maintenance service provider as well as in approving the plans to upgrade and expand the capacity of MRT 3,” he said.

Malacañang earlier issued Executive Order 126, directing the DOF and the DOTC to buy out the MRTC. Once the government takes over the MRT 3, it plans to privatize its operation and maintenance.

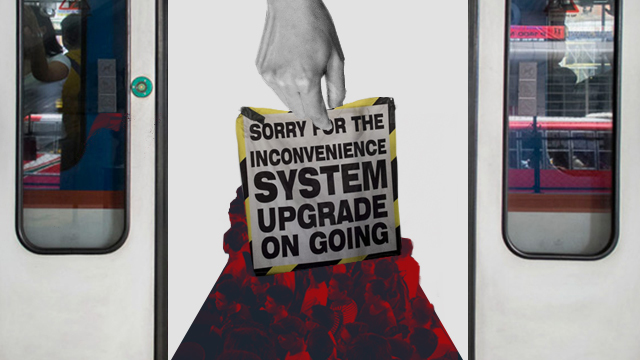

The MRT 3 is designed to accommodate only 350,000 passengers but it actually transports an average of 540,000 commuters daily. Passenger overcrowding contributes to the wear and tear of the mass transit system, making it more vulnerable to glitches.

The MRT 3’s private owner, MRTC is 100 percent owned by MRTH II, which in turn is 85 percent owned by MRTH I. The remaining 15 percent stake at MRTH II is held by different individual stakeholders.

Meanwhile, 18.6 percent stake at MRTH I is held by the Ayala Land Inc., 18.6 percent by Ramcar of Augustines Group, 18.6 percent by Anglo of National Bookstore Group, 16 percent by Sheridan of Unilab Group and the remaining 18.6 percent is held by Metro Global of Fil-Estate Group together with DBH of Seiko Group and Emerging of Lao Group.

Twitter

Twitter Facebook

Facebook