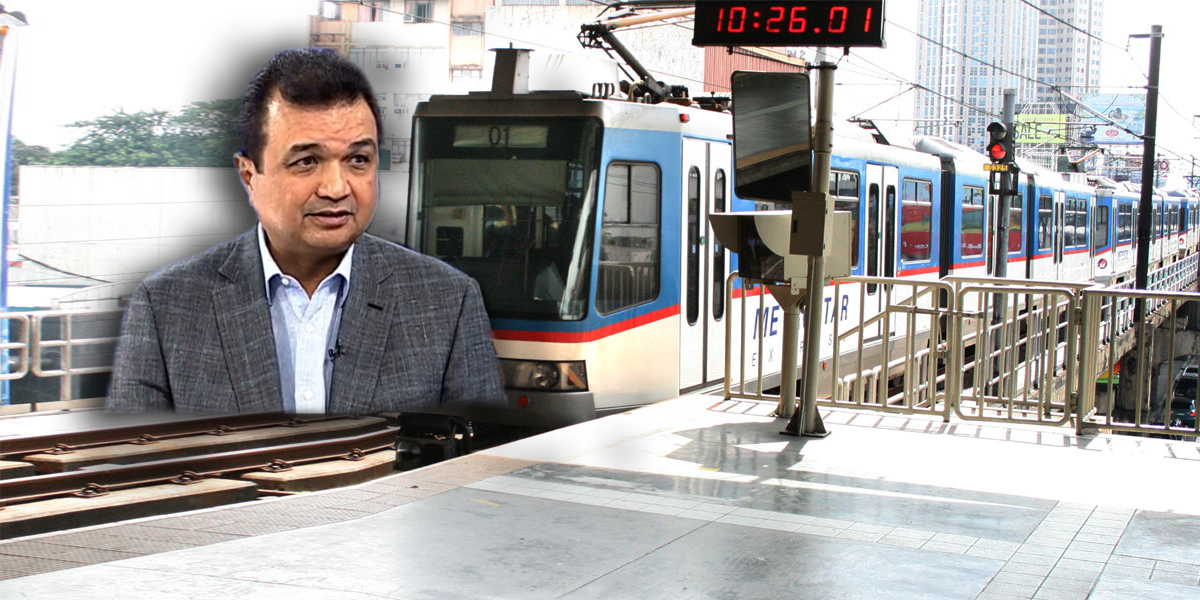

abs-cbnNEWS.com | Feb 03, 2011

MANILA, Philippines - Metro Pacific Investments Corp. (MPIC), the local infrastructure arm of First Pacific Co. Ltd., on Thursday revealed that its interest in the Metro Rail Transit 3 now stands at 48%.

"We have 48% in terms of economic interest," said MPIC president Jose Ma. Lim.

MPIC's interest, according to Lim, is broken down as follows:

- 28% from the Sobpreña-owned Fil-Estate Corp.

- 16% from Anglo Philippine Holdings Corp.

- 4.5% from DBH Inc

MPIC previously acquired the stake of the Fil-Estate group in November 2010.

"We have come to an agreement with Anglo and DBH. They have an agreement with us to sell out their shares," added Lim.

The closing of the transaction, said the official, is subject to certain requirements.

The government, through the Land Bank of the Philippines and the Development Bank of the Philippines, owns 23%. MPIC is in discussions with small private shareholders that own the remaining 22%.

"We are in discussions with (small private shareholders). We can't say when and we don't know if they will sell it to us," said the MPIC official.

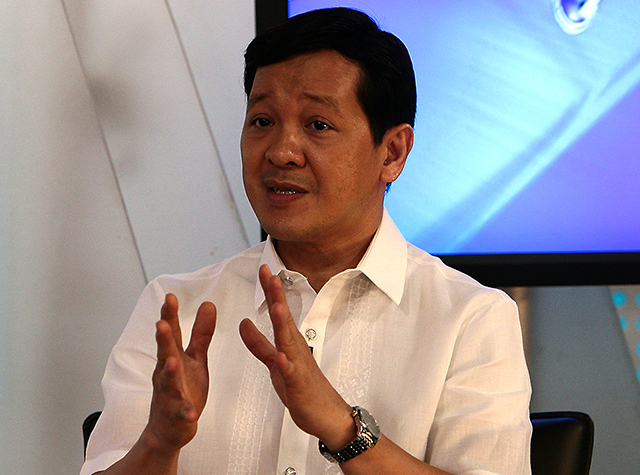

Even MPIC chairman Manuel Pangilinan could not provide any timeframe. "It is really up to them. Discussions are ongoing," he said.

Pangilinan said MPIC and the transportation department are in continuous discussion in relation to the latter's proposal to buyout the government's stake for $1.1 billion and rehabilitate the entire railway system for at least $300 million.

This proposal was submitted to the Department of Transportation and Communications (DOTC) last January 17.

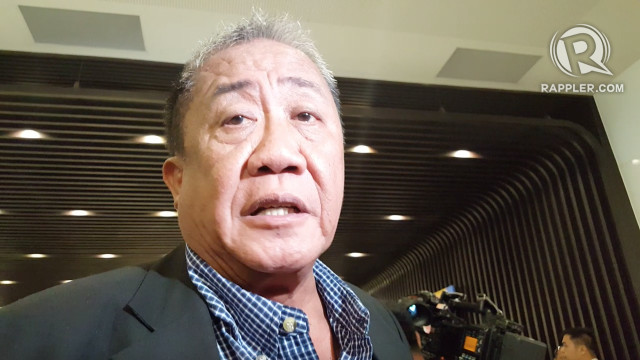

According to Glicerio Sicat, transportation undersecretary for rail and aiport, MPIC's offer is attractive but government prefers to bid out the project.

"Metro Pacific is a very good group. We respect them and we want to partner with them but the reason why we hesitate is because Secretary de Jesus wants to bid it all so that everything is transparent," said Sicat.

He stressed though that the agency has not decided on anything yet. In fact, the DOTC wishes to seek a meeting with the MPIC to clarify some matters it raised in the proposal.

MPIC stressed that its proposal aims to achieve three objectives:

- to retire the DOTC's obligation to pay ERPs (equity rental payments) to Metro Rail Transit Corp. (MRTC), thereby eliminating DOTC's annual subsidies

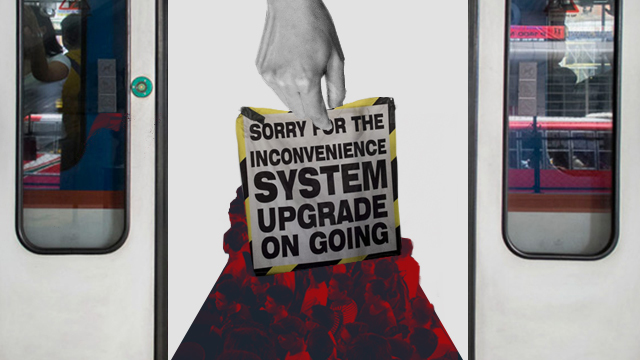

- to double MRT3 capacity

- to seamlessly integrate MRT3 with LRT (Light Rail Transit) lines 1 and 2.

To successfully carry these out, MPIC will need to

- retire DOTC's obligations to MRTC

- amend the Build-Lease-Transfer contract

- expand the MRT3 capacity

MRTC is 100% owned by Metro Rail Transit Holdings II, Inc. (MRTH-II), which, in turn, is currently owned by

- 84.9% - Metro Rail Transit Holdings, Inc. (MRTH-I), which is in turn ovvned by

- 18.6% - Fil-Estate Corp.

- 18.6% - Anglo Phil. Holdings Corp.

- 18.6% - Railco Investments, Inc.

- 16% - Sheridan LRT Holdings, Inc.

- 4.8% - Landbank

- 4.8% - DBH Inc.

- 8.7% - Fil-Estate Properties, Inc

- 4% - Fil Estate Corp.

- 1.4% - Railway Systems Holdings Co., Inc.

- 1% - Rapid Urban Transit Holdings, Inc.

- other smaller shareholders

MPIC said it intends to acquire a 19.9% interest in MRTC through common shares of MRTH-I which are held by Landbank and Development Bank of the Philippines and a 2.4% interest in MRTC through common shares of MRTH-II which are also held by government financial institutions (GFIs).

Twitter

Twitter Facebook

Facebook