By Jarius Bondoc | The Philippine Star | October 30, 2015

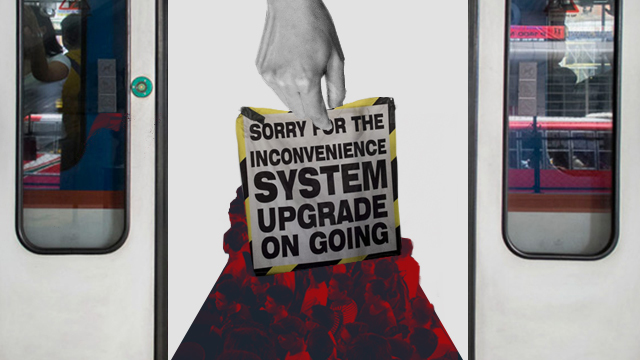

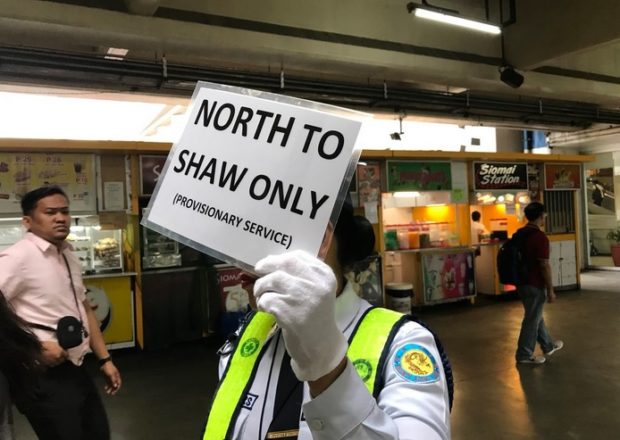

Secret talks for a three-year rehab of the MRT-3 commuter rail ended yesterday, with Transport Sec. Joseph Abaya’s preferred company bagging it.

That company is represented by a fundraiser of the Liberal Party, of which Abaya is acting president.

The company led by Korea’s Busan Transport Corp. with four Filipinos as joint venture partners, had bid P3.8 billion to:

• maintain for three years the MRT-3 trains, tracks, power supply, signaling system, and stations;

• overhaul 43 light rail vehicles (coaches);

• totally replace the signaling; and

Opinion ( Article MRec ), pagematch: 1, sectionmatch: 1

• render other maintenance works.

The Abaya’s Agency Budget for Contract was P4.25 billion.

The anomalous contract, done in absolute secrecy instead of public bidding and on contrived emergency, is set to be awarded next week.

The secret talks had turned dour last Wednesday, as Abaya set to grant it to his Liberal Party-mate. This was exposed in Gotcha on that day.

Cussing and shouting racked the closed-door session for the rehab of the MRT-3 commuter rail, sources disclosed.

Heated exchanges ensued over the pre-qualification of only one of three interested parties, the joint venture of Busan with the four Filipinos.

Two other Filipino companies, each with European partners, sensed a railroading of the talks in favor of Busan, sources said. They were the giant DMCI (David M. Consunji Inc.), which is into mining, land development, and infrastructures; and CommBuilders and Transport Inc., the long-time maintenance servicer of the MRT-3’s sister LRT-1.

The Filipino partners of Busan reportedly are associated with a fundraiser of the LP. The negotiations’ terms of reference (TOR), particularly on Filipino equity, had been altered to suit them, sources added. That caused the tensions.

That LP moneybag directly handled the MRT-3’s maintenance since Oct. 2012, starting which the railway rapidly deteriorated to its present state.

It is precisely for the dilapidation that the P4.25-billion rehab is being undertaken.

Last Wednesday’s arguing were over Busan’s shady compliance with the equity requirements for its Filipino joint venture partners. It arose because Abaya’s designated screeners of the negotiating parties had changed the rules midstream.

In the original TOR, part of Abaya’s 447-page prospectus, is stated: “Section 6.1.10. Net worth of Offeror’s local partner/s (in case of JV), which must be at least 50% of the ABC.”

That means the Filipino partner(s) must have a net worth of P2,125,950,000, or one-half of the Approved Budget for Contract of P4,251,900,000.

Busan on its own has a net worth of P138,613,205,682. But none of its four Filipino partners, much more all of the latter combined, could reach the required P2.13 billion, namely:

• Edison Development and Construction Corp., P383,527,493;

• Tramat Mercantile, P501,900,000;

• TMI Corp., P150,753,437; and

• Castan Corp., P4,557,707.

Instead, the equity rule substantially was changed to: “Net worth of the Offeror, regardless of nationality, must be at least One Billion Pesos (P1,000,000,000.00). Provided further, that in the case of a Joint Venture each member with at least twenty-five percent (25%) equity share must have a net worth of at least One Billion Pesos (P1,000,000,000.00). The basis for the net worth shall be the 2014 Audited Financial Statements of the Offeror or the members of the Joint Venture.”

Thus, suddenly the JV of Busan-Edison-Tramat-TMI-Castan became qualified by virtue of the Korean’s P138-billion net worth.

But such lopsided net worth of Busan’s P138 billion against the four Filipino partners’ combined P1,040,738,637 would have made the foreigner dominant. It would negate the earlier Section 5 on Eligibility, which requires “Offerors to be Filipino citizens, partnerships, or corporations.”

So in its submissions to the Dept. of Transportation and Communications, the JV members declared their equity percentages to be unbelievably disproportionate with their net worth, to wit:

• Busan, P138.6 billion, four percent;

• Edison, P383.5 million, 24.5 percent;

• Tramat, P501.9 million, 24.5 percent;

• TMI, P150.7 million, 24.5 percent; and

• Castan Corp., P4.5 million, 22.5 percent.

Yet, despite Busan’s mere four percent share of net worth on paper, the JV banks heavily on its track record. The four Filipino partners insist that only Busan meets the basic requirement of at least 15 years’ experience in the P4.25-billion rehab; that is, the supply of signaling system.

Their websites show the four Filipinos to be experts in anything but railways. Edison is into construction, Tramat into agricultural equipment supply, TMI into trading, and Castan into plumbing. Tramat and TMI have the same address: 749 Sabino Padilla St., Sta. Cruz, Manila.

Twitter

Twitter Facebook

Facebook